This abbreviated article, originally published in the Canadian Property Valuation Magazine, discusses some of the similarities and differences between going-concern appraisals prepared by commercial real estate appraisers and business valuation reports completed by business valuators.

What’s a going-concern?

The CBV Institute defines“Going-Concern Value” as follows:

“The value of a business enterprise that is expected to continue to operate into the future. The intangible elements of Going Concern Value result from factors such as having a trained work force, an operational plant, and the necessary licenses, systems, and procedures in place.”

Hotels, seniors housing, self storage facilities, and other special-use properties are typically valued on a going-concern basis by real estate appraisers. The term “Going-Concern” is defined in The Appraisal of Real Estate (3rd Edition) as follows:

“All tangible and intangible assets of an established and operating business with an indefinite life.”

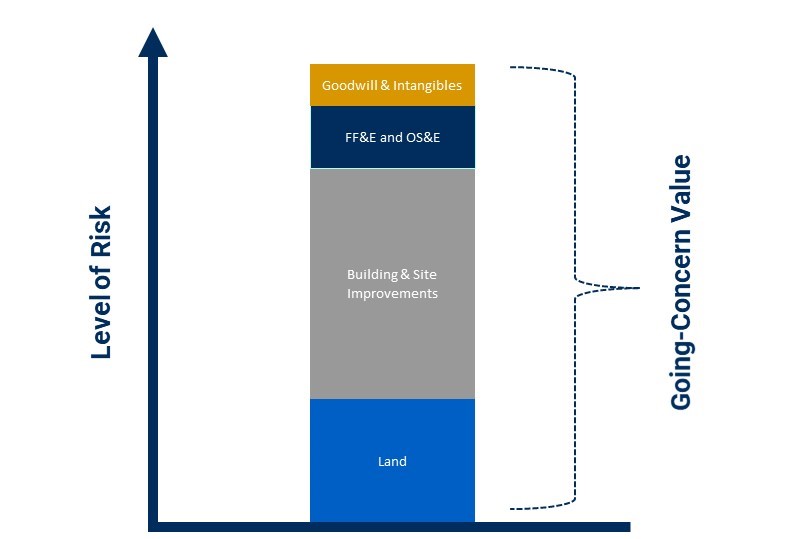

In the context of real estate appraisal, the going-concern value of a property is effectively the sum of value attributed to:

- Land;

- Building & Site Improvements;

- Furniture, Fixtures, and Equipment (FF&E) and Operating Supplies and Equipment (OS&E); and

- Goodwill and intangibles, if any.

Each of these components of value is characterized by a different risk-return profile, as illustrated below.

Please Contact Us with any questions on going-concern valuations – we’re here to help!