This article, originally published in the Real Estate Magazine (REM), discusses cap rates and multiples, common terms used by investors, brokers, lenders and appraisers in the context of commercial real estate and/or private business valuations. Here’s a list of the top 5 things you need to know about these seemingly simple metrics.

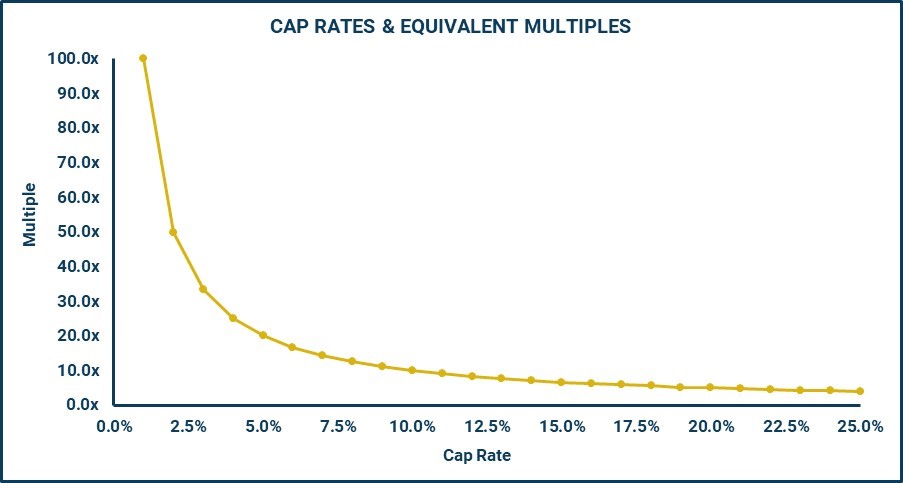

#1) A cap rate is the inverse of a multiple, meaning a 10% cap rate is equivalent to a 10.0x multiple just as a 5% cap rate is equivalent to a 20.0x multiple

The chart below illustrates this relationship.

The annual cash flow (or some other measure of economic benefit) of an asset can be divided by a cap rate or multiplied by its equivalent multiple, the resulting value will be the same. For example, a 5.0% cap rate is equivalent to a 20.0x multiple (1/0.05) therefore whether you divide by a cap rate or multiply by its equivalent multiple, the resulting value will be the same. See below.

Value = Annual Cash Flow / Cap Rate = $50,000 / 5.0% = $1,000,000

Value = Annual Cash Flow x Multiple = $50,000 x 20.0 = $1,000,000

#2) Cap rates and multiples are used to convert a single period of economic benefit into value.

The ‘economic benefit’ is typically expressed as an annual amount and although cash flow is preferred, practitioners can also use other metrics such as Revenue, Earnings Before Interest & Tax (EBIT), Earnings Before Interest, Tax, Depreciation &Amortization (EBITDA), and/or Net Operating Income (NOI), to name a few. In the end, how the cash flow is calculated determines the characteristics of the resulting value (i.e., Enterprise Value, Equity Value, Terminal Value, etc.).In other words, capitalizing (dividing) or multiplying the annual cash flow of an asset will produce an estimate of value but understanding how that cash flow estimate was derived (before debt vs. after debt, before-tax vs. after-tax,Year 1 vs. Year 5, TTM Actual vs. Normalized Pro Forma, etc.) is of critical importance. The cap rate (or multiple) is inseparably linked to the economic benefit to which it is applied, meaning that estimating one in isolation of the other can result in a misleading estimate of value.

#3) Cap rates and multiples assume the economic benefit will continue in perpetuity.

Using our earlier example, an investor purchasing an asset for $1,000,000 at a 5.0% cap rate would expect to receive$50,000 in the current year, and all future years – or does it? Implicit in the cap rate (or multiple) is a growth rate, meaning the investor would expect the$50,000 to grow at a constant rate of x% in perpetuity. This is similar to the valuation of a stock using the Gordon Growth Model, also known as the Dividend Growth Model.

#4) Cap rates and multiples reflect the perceived risks associated with the underlying cash flow.

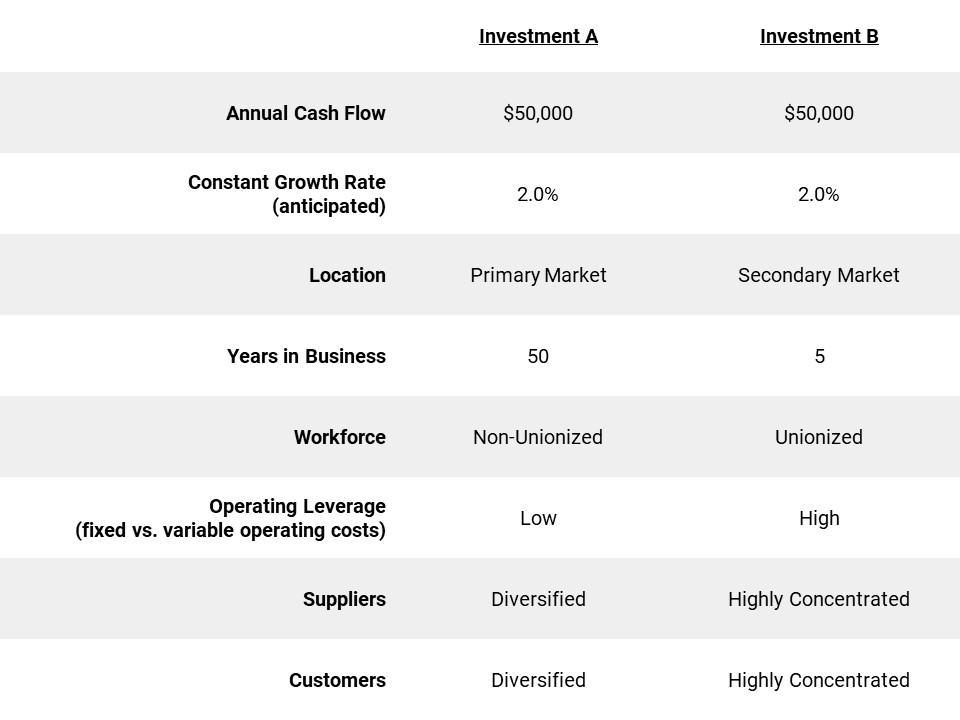

All else equal, greater perceived risk means a higher cap rate (lower multiple) which ultimately results in a lower valuation. Let’s look at two potential investment opportunities:

Should you apply the same cap rate (or multiple) to Investment A as Investment B? No, although each investment generates $50,000 in cash flow Investment B has more risk even though it has similar growth prospects. In other words, why would an investor pay the same amount for Investment B if he/she can purchase Investment A which generates the same cash flow but with less risk?

#5) Cap rates (and multiples) do not distinguish between return of capital and return on capital.

Assuming the cap rate used in the acquisition of an asset will equal the investors return on investment is almost always incorrect (more on this in another article). In real life, cash flows and values rarely increase at a constant rate, investors use varying degrees of financial leverage (debt),and taxes can have a material impact on how much cash the investor is left within his or her pocket at the end of the day.

Summary

Cap rates and multiples are easy to use but as they say, “The devil is in the detail”. While some investors focus solely on the cap rate (or multiple) when evaluating investment opportunities,sophisticated investors understand these metrics are only a starting point.

Contact Us for a confidential discussion today.

This article was also posted in BVWire News.